Covid consumption: Seafood Source report that the amount of fish and seafood sold by major retailers has ‘dramatically’ increased over the past year. The latest Nielsen data published by Seafish shows that UK shoppers bought five percent more fish and seafood over the twelve months from June 2019 to June 2020. The total consumption was 412,267 metric tonnes, but this includes ambient and frozen as well as chilled. Of the total, chilled seafood accounted for 60% of sales and overall sales increased by 2 percent to 182,199 tonnes although the value fell by 0.8%. Seafood Source hypothesises that any sales increase has occurred due to the closure of restaurants and other forms of food service, which in turn has encouraged more people to buy fish and eat it at home.

Certainly, some of the early indications of the early effects of lockdown on the British public suggested that panic buying of ambient and frozen fish caused sales to rocket. At the same time, the closure of most supermarket fish counters meant that the availability of fresh fish plummeted. However, as Seafood Source recognised, the inability to eat out has meant that more people have chosen to eat fish at home.

The big questions are whether the increase is significant, and can it be sustained?

What is clear is that year on year figures don’t really give a clear picture of what is happening to consumption because any changed behaviour that happened after lockdown towards the end of March accounts for only one quarter of the last twelve months. Before March, shopping behaviour and home consumption was effectively normal or as normal as normal could be,

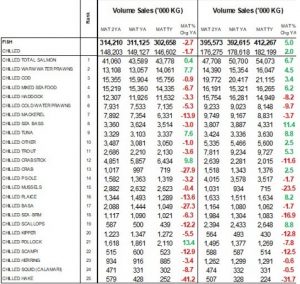

The following table is an amalgam of the chilled volume figures for February (on the left) and June (on the right). The interesting aspect is to compare how many red numbers there are for each month. A red number represents a decline in sales whilst a green one shows an increase. Clearly there was a change between February and June with more products showing an increase in sales. However, what might be of concern is that any increases are relatively small, suggesting that whilst more people bought chilled fish during the lockdown, the increase was relatively modest.

It is worth mentioning that during lockdown, a DEFRA funded seafood promotion in conjunction with Seafish, was underway. ‘Sea For Yourself’ was trying to encourage consumers to eat locally caught British fish species. When interviewed on the Fathom podcast, Seafish CEO, Marcus Coleman suggested that this campaign was one of the most successful ever run by Seafish. Much of the promotion had taken place online with features in the Times and to a lesser extent in the Guardian. The promotion might have been also posted elsewhere, but I am unaware of any other outlets. I am in no doubt that measured by online hits etc, the campaign will be judged to be a success, however for me the measure will be whether fish and seafood consumption has actually increased and consumers are eating more of the species promoted. This will be difficult to assess for some time yet, however initial observations are not encouraging.

Firstly, I have previously mentioned that the only physical incarnation I have seen of the ‘Sea For Yourself’ campaign was a sticker attached to a box of mixed fish sold by Morrisons. Given these fish were all whole and ungutted, I did wonder how much appeal they would have to most consumers despite the very cheap price. After an initial launch period, the fish box was reduced in size and the price increased. I have not seen these fish boxes in Morrisons for some weeks. I am presuming they have been delisted. Morrisons were also interviewed on the Fathom podcast and said that sales had increased after fish counters were reopened. This was not a major surprise given that expensive species such as monkfish, Dover soles and scallops were all being offered at half price. This deal ran for about a month after which prices rose and looked much less attractive to consumers.

Most supermarkets are now running fish promotions in exactly the same way they did prior to lockdown. Thus, it can be assumed that supermarket activity might be considered to now be back to normal, although some fish counters have yet to reopen. I will be watching with interest how sales develop in the coming months. My concern is now that restaurants are re-opening, consumers will be less incentivised to buy fish for home consumption. Early indications are that consumers are looking less for treats at home and searching these elsewhere. I have been supporting a local restaurant by having their dishes, including a variety of fish options, delivered to heat and serve at home. Over the past months, it has been necessary to order almost as soon as the menu was posted in order to ensure a delivery slot. Last week, the restaurant, which is too small to open, messaged at the end of the week that they still had delivery slots available. I am sure that I am like their other customers in that I would love to return to eat at the restaurant but there are other restaurants that are now open and it is not just eating the food, but also the experience which is important. Unfortunately, I think we will see a similar response when it comes to chilled fish and seafood sales. I am not convinced that consumers who started to buy fish during lockdown will continue to do so as more other choices become available.

Seafish announced in June that the ‘Sea For Yourself’ would be extended until the end of July. I have seen a couple of postings in the Times but little else. I have previously mentioned that the ‘copy’ used in these posting does not seem to have been written by anyone with an understanding of the market. For example, the article about one of the oldest trout farms in Scotland related how they marketed their fish as Steelhead trout. However, anyone reading this article would be unable to find Steelhead trout in most of the usual fish outlets. This is because such trout grown in the sea are usually sold under the name of Loch trout in the UK. The link between the two wasn’t highlighted and thus this was a market opportunity lost. Another article promoted sea bass, no doubt because the fish are line caught by small scale fishermen. These fish more usually ended up in restaurants or in specialist fishmongers not in the wider marketplace. It is possible to see that the ‘Sea For Yourself’ campaign would want to promote this form of fishing and the produce. However, most sea bass sold in this country is farmed in Turkey or Greece and thus sales are not really benefiting local fishermen.

Finally, Intrafish reported in May that Seafish were painting a bleak picture of things to come in future years. They forecast that there will be a 30% decline in seafood consumption over the next five years. They base this forecast on how the market reacted after the financial crisis of 2007/8. I think that whilst it is clear that many people will be impacted by the fallout from Covid with job losses and reduced personal circumstances just as they were in 2007/8, I believe that any further decline in fish consumption is the result of long term trends in how people perceive and eat fish at home. Sadly, campaigns such as ‘Sea For Yourself’ will fail to reverse the downward trend because they are simply giving out the wrong messages to the wrong consumers at the wrong time.

It is worth remembering that both Tesco and Asda made the decision to close their fish counters long before Covid hit. They recognised that consumers were no longer interested in what they had to offer. I believe that the wider industry needs to recognise that too.

Closed: Last month, the Caterer magazine reported that Jocelyn Neve was heartbroken as her Seafood Pub Company went into administration. I suspect that most reLAKSation readers didn’t even notice the news that this 10 strong pub restaurant chain closed down. After all, restaurant closures are in the news almost every day. The news was of more interest to me because Jocelyn is part of the Neve family who run a fish business in Fleetwood, Lancashire.

The pub chain was also based in Lancashire and whilst I haven’t eaten in any of the pubs, I have eaten a fish and chips takeaway from one of them. The business went into administration because it couldn’t access government funding. It also claims that one off expenses for restructuring also pushed the company to a loss.

I struggled with the concept of a pub serving a seafood menu and this is why I think they had to restructure. The reality is that people visiting small country pubs in the wilds of the Lancashire countryside expect to see typical pub dishes and not a specialised fish menu. That might work in an urban area where there is a lot of choice for consumers or near the sea but not in the depths of the country.

In fact, last time I looked at one of the menus, they had tried to introduce a more varied menu but by then they weren’t really a seafood restaurant anymore.

This is not the only closure I have heard about in recent times. iLaks reported that the Pink Fish chain has closed its Bergen restaurant. Sadly, this comes as no surprise.

Pink Fish was a chain of five restaurants in Norway and one in Singapore. The concept was simple – a fast food style restaurant serving salmon with choices such as burgers and Poke bowls. However, the chain has not been an overriding success. The owners had previously closed the outlet in Oslo city centre saying that the potential market was young people but that they were unwilling to spend their money on fish meals. The Bergen outlet closed because of a very low footfall. The three remaining stores are staying open for the time being, but the owners say that they will now concentrate on stores outside Norway.

This news is far from the original ambition. Intrafish had previously reported that the company had planned over ten new restaurants in Norway and then to become a world player with at least 1000 stores.

Given a model of fast food burgers or fried chicken, a salmon restaurant could be perceived as having potential. However, the reality is that fish is viewed very differently to existing convenience fast food choices. It is interesting that fish hardly appears as a choice in the well-known outlets. McDonalds for example offer a fillet-o-fish but the chances are that even if placing an order at a busy time, the fish choice always has to be made to order, simply because the demand is not there.

Salmon is a highly versatile food that can be incorporated into many different dishes but consumers like a choice and a restaurant that serves just salmon is not really that attractive in the marketplace. However, I suspect that this would apply to any fish not just salmon. The fact that salmon can be used in so many different cuisines is its strength, and one on which we can all capitalise.

Taste of Truffle: It’s been a while but because of Covid and the focus on wild fish, there hasn’t been an opportunity to taste any of the new fish and seafood-based products that have caught my attention.

Fishcakes have always been a popular dish with the public, even when eating out. However, in recent years, the retail sector has tried to enliven the traditional flavours with a range of new recipes. One that has stood out as being rather novel can be found in Asda’s freezer section and this is Extra Special king prawn & truffle mac ‘n’ cheese fishcakes. These are pieces of king prawn mixed in a macaroni cheese with added black summer truffle wrapped in a crispy sourdough crumb.

The 280g pack of four fishcakes sells for £2.60 but is currently on offer at £2.

The fishcakes are simple to cook in the oven for 25 minutes

The taste of the fishcakes is difficult to describe. They are very unusual but at the same time strangely rather addictive. Certainly, opening a fishcake to find macaroni cheese would be unexpected but mac ‘n cheese is very popular amongst the young and it might be hoped that if these fishcakes came to their attention, that they might be willing to give them a try. I certainly hope they do. These fishcakes are sufficiently different that I hope that they are a success.